Extended Term Insurance Calculation

50 lakh and Opt for Old tax regime Save 54600 on taxes if the insurance premium amount is Rs15 lakh per annum for life cover and 25000 for critical illness cover and you are a Regular Individual Fall under 30. If the investment portion of the insurance policy is sufficient to cover payments for it the holder of an extended term insurance can simply modify their whole life insurance policy into a term life.

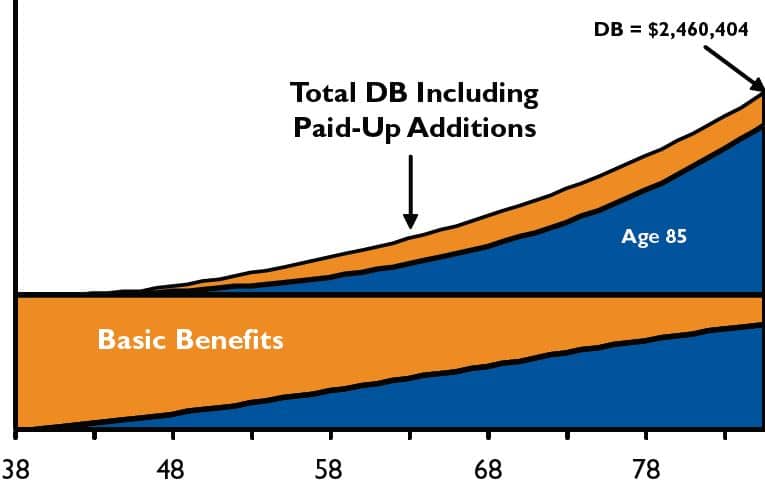

Understanding Whole Life Insurance Dividend Options

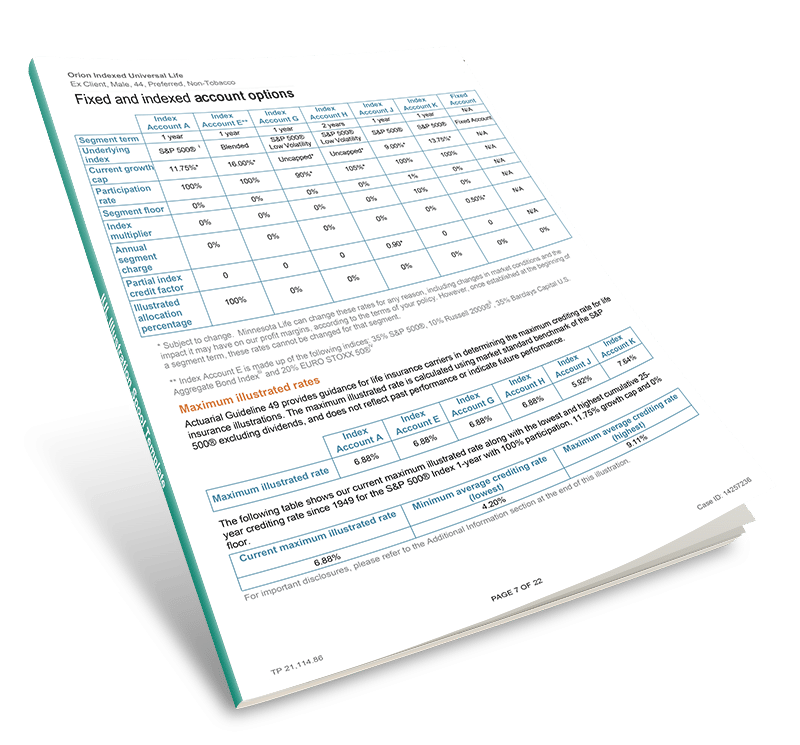

The exact calculation used by life insurers will vary from company to company but they all will generally fall relatively close to one another.

Extended term insurance calculation. Insurance law first The first priority of insurance protection is stated in the opening statement. With the extended term insurance the face amount of the policy stays the same but it is flipped to an extended term insurance policy. For example if you purchase a policy when you were 20 years old and you paid until age 55 you would receive a term policy that is less than 35 years.

Thus a term insurance premium calculator is a convenient tool to give you an idea of the premium required for a particular term insurance plan. Then calculate the one-year term insurance rate to 100 years old. The individual would then be covered by a term life insurance policy that lasted for a.

Lets assume you own a whole life policy with a 500000 death benefit and 20000 of cash surrender value. Save an additional 25 on your premiums when you select to pay annually 7. Every Month 6 Months Year.

The calculator is simple to use and can be very helpful when you plan to purchase a term insurance plan. It does however allow the face amount of the policy to remain the same for a specified period of time. A term insurance policys gross premium is calculated by the term insurance calculator as net premium loading.

Due to a job loss you no longer have the ability to pay the whole life premiums but you still. It is also the only function to protect the family members who earn money to support the family after an accident. If any policy reinsured under this Agreement is changed to Extended Term Insurance the net amount at risk reinsured will be adjusted as.

People who depend on their families to. The net premium depends on the mortality rate investment earnings and the lapse rate and loading are the companys operating costs. The policy will contain a table that illustrates the length of time.

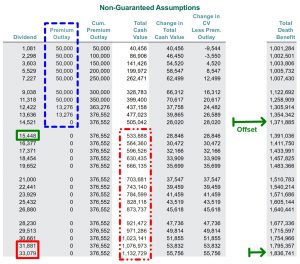

These Net Cash Value is then converted into a Single Premium which extends the Term Insurance of the. 3113 Extended Term Insurance. Insuranceopedia Explains Extended Term Insurance.

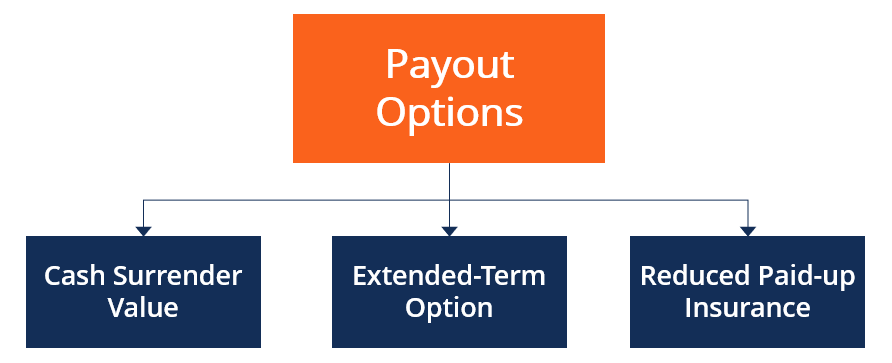

The extended term insurance option differs from the reduced paid-up insurance option as it does not allow the policy to continue to earn interest increase cash value or pay dividends if dividends are applicable. The calculator then tells you how much coverage you require to adequately protect your family. Online discount applied throughout policy term.

Extended Term Insurance Calculation and Example. A term insurance calculator is an online tool that helps you calculate the coverage amount necessary as per your requirements. Save 46800 on taxes if the insurance premium amount is Rs15 lakh per annum and you are a Regular Individual Fall under 30 income tax slab having taxable income less than Rs.

Extended term insurance allows policyholders to stop paying premiums once the cash value of the policy grows to a self-sustaining amount. The insurance company would take the cash balance that is remaining on the policy and then use that amount of money to purchase term insurance. Not The Same as Extended Coverage.

This is not to be confused with extended coverage a term used in the property insurance business. The equity you built is used to purchase a term policy that equals the number of years you paid premiums. An option provided in some policies to continue the insurance for a particular insured amount as per.

That is all the more reason to use a term insurance calculator and take one more step towards securing your familys future. Net Cash Value Cash Value of the Policy Debt Raised against the Policy Administrative Charges in Conversion. When you use the ETMONEY Term Insurance Calculator you just need to provide a few necessary inputs.

Then calculate 240 or 120 or 20 periods for you to pay all the premiums. Extended Term Life Insurance is Calculated using the Net Cash Value left in the Whole Life Insurance Policy. Extended Term and Reduced Paid-Up Insurance.

How is Extended Term Insurance Calculated. Whenever an individual could not afford to continue paying their premiums they would instead be able to get extended term insurance. For a duration of 40 years 45 years 50 years 54 years 60 years cover till 99 years of age.

Extended-Term Insurance Choosing the nonforfeiture extended term option allows the policy owner to use the cash value to purchase a term insurance policy with a death benefit equal to that of the. Insurers these days also offer good discounts if one buys a policy online. What is Extended Term Insurance.

It also recommends the best policies offered by different insurance. Extended Term Insurance a nonforfeiture provision in a whole life policy that uses cash value to purchase term insurance equal to the existing amount of life insurance. By paying a premium of.

Extended term insurance is life insurance is a life insurance policy where the policy holder stops paying the premiums but still has the full amount of the policy in effect for whatever term the cash value permits. If any policy reinsured under this Agreement converts to Extended Term Insurance or Reduced Paid-Up Insurance the net amount at.

Open Enrollment 2022 Guide Healthinsurance Org

What Is The Extended Term Insurance Option The Insurance Pro Blog

Nonforfeiture Options Of Whole Life Insurance The Insurance Pro Blog

What Is The Extended Term Insurance Option The Insurance Pro Blog

What Is Reduced Paid Up Insurance Rpu One Of Whole Life S Non Forfeiture Options Banking Truths

15 Best Life Insurance Companies Top Rated Providers For 2020 Best Life Insurance Companies Life Insurance Companies Life Insurance

What Is Reduced Paid Up Insurance Rpu One Of Whole Life S Non Forfeiture Options Banking Truths

Answer Key Ic Mock Exam Set A Pdf Pdf Life Insurance Insurance

How Much Does Million Dollar Life Insurance Cost Who Needs It

What Is Reduced Paid Up Insurance Rpu One Of Whole Life S Non Forfeiture Options Banking Truths

Nonforfeiture Clause Overview How It Works Payout Options

Health Insurance And Pregnancy 101 Ehealth Insurance

Lic S New Bima Gold 179 Details With Premium And Benefit Calculators Insurance Funda

What Is Reduced Paid Up Insurance Rpu One Of Whole Life S Non Forfeiture Options Banking Truths

Life Insurance Loans A Risky Way To Bank On Yourself

What Is Term Insurance Term Insurance Definition Meaningaegon Life Blog Read All About Insurance Investing

How Hybrid Life Insurance Pays For Long Term Care Forbes Advisor

Life Insurance Loans A Risky Way To Bank On Yourself

What Is Reduced Paid Up Insurance Rpu One Of Whole Life S Non Forfeiture Options Banking Truths

Post a Comment for "Extended Term Insurance Calculation"