What Does Face Value Mean On A Life Insurance Policy

What does face value mean in insurance. They both reflect the amount of money that the insurance company will pay out in the case of a valid claim.

What Does It Mean For A Life Insurance Policy To Mature Life Ant

The face amount of the policy represents the face amount the policy is scheduled to pay out.

What does face value mean on a life insurance policy. Face value can also be used synonymously with face amount or coverage amount. Face value is the. The face value never changes.

Decreasing term life insurance is life insurance coverage in which the face amount of a term life insurance policy declines by a certain specified most people use cash value insurance to describe a type of life insurancei do not really understand what you mean. Cash value or account value is equal to the sum of money that builds inside of a cash-valuegenerating annuity or permanent life insurance policy. This is the minimum that the beneficiary would receive from the policy as long as you dont have an outstanding.

Because this figure is often included on the policys top sheet or face it is often referred to as the policys face value. If you die with a whole life insurance policy in place your beneficiary will receive the policys face value just like with term life insurance. Face of policy refers to the amount of coverage the insured pays for in an insurance policy.

These dividends can be used to buy additional insurance thus increasing the death benefit. What Happens When You Pass Away. The face value can be higher or lower than the original face amount depending on if the policy grew or if loans were taken out against it.

View 10 What Does Face Value Mean On Life Insurance Policy WallpaperWhile nearly all states use a face value exemption missouri is. Life Insurance Policy Valuation Factors. Face value is the amount you purchase the policy for and is used for all life insurance policies even term life.

In this way it. Financial Needs Analysis The. Face Amount can also be called Amount of Insurance Coverage Amount or Sum Insured.

What Does Face of Policy Mean. But dividends are not. The amount of death benefit that the policy will pay is always a substantial factor in determining the value of a life policy.

With each payment before you die a whole life policy accumulates value that you can borrow against at any time. In the case of a graded death benefit the policy will pay a reduced amount for the first 2 or three policy years before going to the actual face amount. For example a policy with a face amount of 1 million will be much more valuable than one with a face amount of 100000.

At the beginning of the policy the face value and the death benefit are the same. Frequently asked and often misunderstood the face amount of life insurance is the initial amount of financial protection listed on a life insurance policy. The face value of a whole life insurance policy is also known as the death benefit of the policy.

The face value of a life insurance policy is the death benefit while its cash value is the amount that would be paid if the policyholder opts to surrender the policy early. The face value of the policy is the death benefit that it provides. The face value of a whole life insurance policy is also known as the death benefit of the policy.

Some of the factors that go into determining the value of your life policy include. The amount of money that your insurance provider puts toward the policy is known as the face value and is the amount that will be paid out to your beneficiaries when you pass away. Within your policy it is officially denoted as the death benefit.

In the case of whole life insurance the Face amount is the initial death benefit that can fluctuate for numerous contractual. Regardless of the performance of the policy investments the face value of the policy will not change. Although that amount is intended to be the paid when the insured dies the final payout of a policy can be increased or decreased.

The Face Amount will be paid in the event of the policyholders death or when the policy reaches maturity. In terms of life insurance it refers to the amount the policyholder would receive upon the insureds death or the death benefit. Face Amount The amount of insurance that an individual buys.

The term face value in life insurance refers to the death benefit that is paid to beneficiaries upon the death of the insured. Some companies pay dividends. The face value of life insurance is how much your policy is worth and more importantly how much life insurance money is paid out when the policyholder dies.

It does not include any extra benefits that might be payable under accidental death or other special provisions. The face value of a life insurance policy is the amount the policy would pay out if the insured person died at that point in time. However as time goes by they can begin to diverge.

In the case of a typical level term life insurance the Face Amount is the amount of insurance for the guaranteed length of time.

What Does It Mean When A Life Insurance Policy Is Paid Up Life Ant

Colonial Penn Life Insurance Review Quick Coverage But Limited Payouts Valuepenguin

How Does Whole Life Insurance Work Costs Types Faqs

How Does Life Insurance Work Forbes Advisor

Need Cash Tap Your Life Insurance Policy Forbes Advisor

Difference Between Cash Value And Face Value In Life Insurance

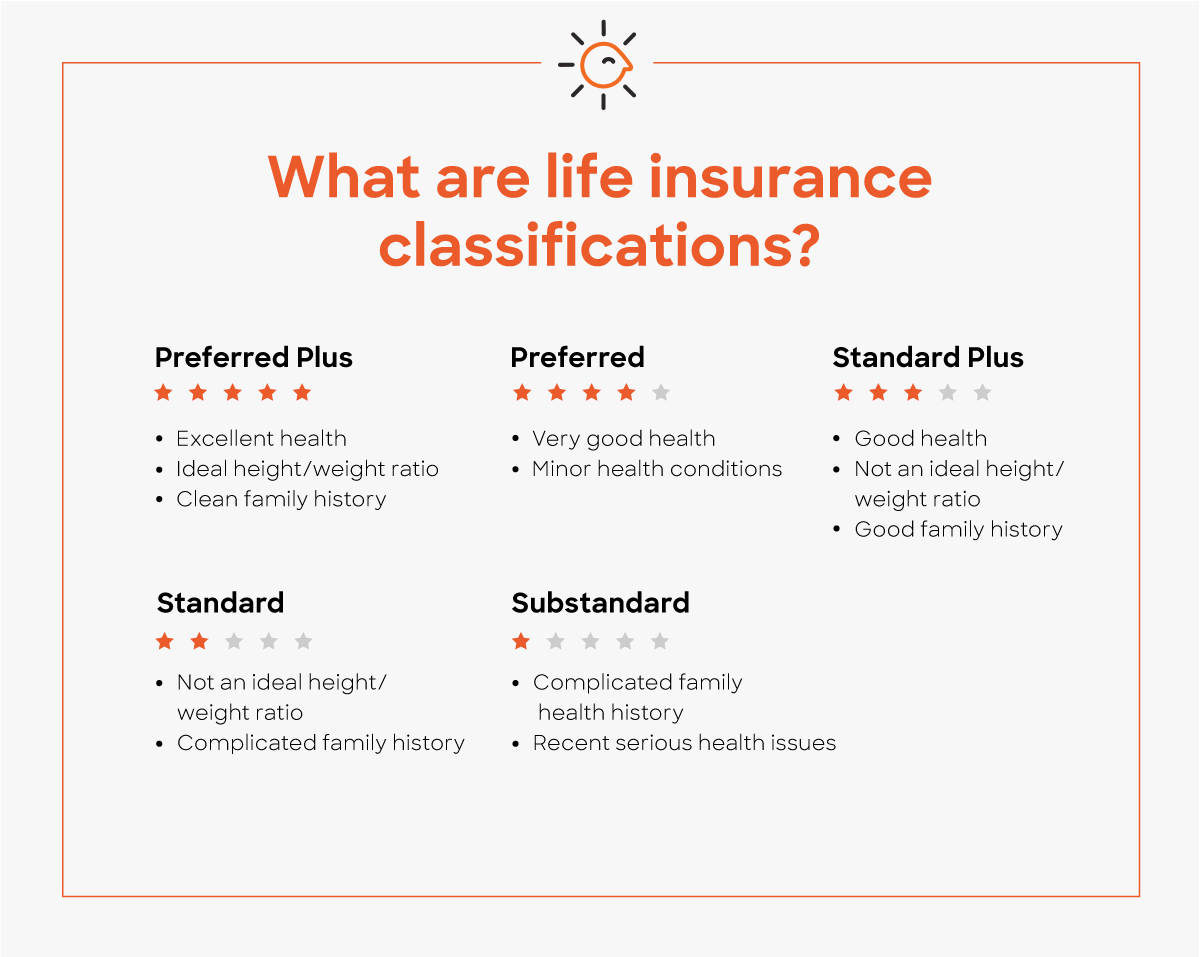

Understanding The Life Insurance Medical Exam Policygenius

/GettyImages-1199059338_journeycrop_lifeinsurance-d3498103ef78406991ea4b4a7b401266.jpg)

Life Insurance Guide To Policies And Companies

Types Of Life Insurance Policies Forbes Advisor

/life_insurance_151909996-5bfc371046e0fb005147a943.jpg)

How Cash Value Builds In A Life Insurance Policy

17 Best Life Insurance Companies Of August 2021 Money

Term Vs Whole Life Insurance Policygenius

What Is Term Life Insurance And How Does It Work Money

Can Life Insurance Be Cashed In Before Death Life Ant

Can I Withdraw Money From My Universal Life Insurance Policy Life Ant

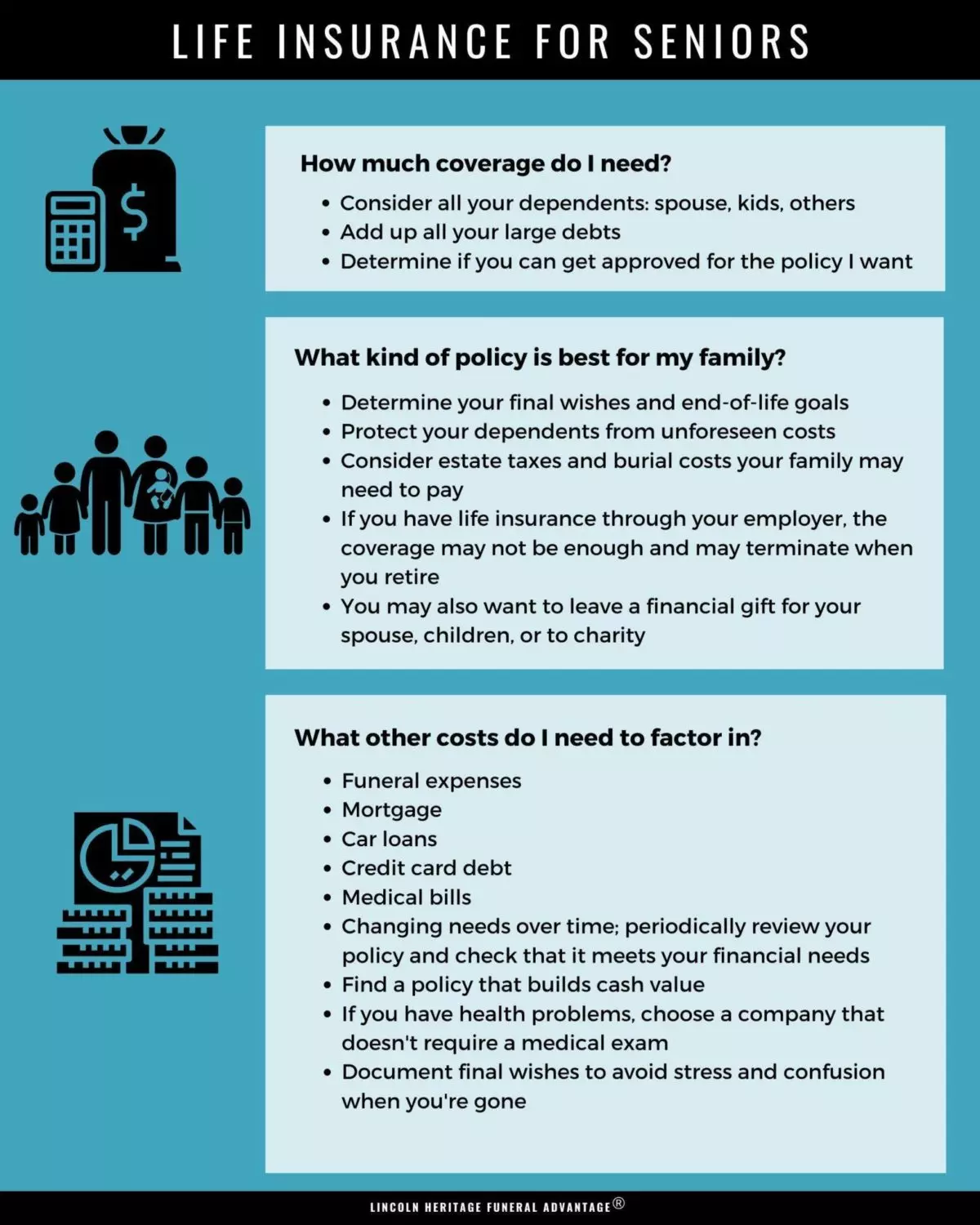

Best Life Insurance For Seniors

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole Life Insurance Definition

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)

Post a Comment for "What Does Face Value Mean On A Life Insurance Policy"