Define Face Value Of Life Insurance

Term life insurance on which the face value slowly decreases in scheduled steps from the date the policy comes into force to the date the policy expires while the premium remains level. Within your policy it is officially denoted as the death benefit.

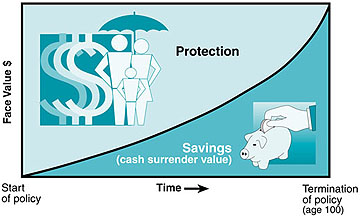

Whole Life Insurance How It Works

Face value can also be used synonymously with face amount or coverage amount.

Define face value of life insurance. Also some life insurance policies provide a face amount that decreases over time usually to cover a mortgage or installment loan in exchange for a lower policy premium. Regardless of the performance of the policy investments the face value of the policy will not change. The face value of indexed life insurance policies varies with the performance of the financial index the policy follows.

A coinsurance clause is any. 1 the face amount of the policy requiring insurance 2 the total face amounts of the insureds applicable policies or 3 under provisional reporting form policies1 full insurance on the property values last reported before a loss. In the case of a typical level term life insurance the Face Amount is the amount of insurance for the guaranteed length of time.

For any life insurance policy the face value is the death benefit. However as time goes by they can begin to diverge. Face value is the amount you purchase the policy for and is used for all life insurance policies even term life.

Therefore the face value is also referred to as the death benefit. In the case of whole life insurance the Face amount is the. This is the basic amount the beneficiary would receive when the insured dies.

Face value or par value is the dollar value of a bond or note generally 1000. That is the amount the issuer has borrowed usually the amount you pay to buy the bond at the time it is issued and the amount you are repaid at maturity provided the issuer doesnt default. They both reflect the amount of money that the insurance company will pay out in the case of a valid claim.

Face value is the initial value of the policy. At the beginning of the policy the face value and the death benefit are the same. The face value of a whole life insurance policy is also known as the death benefit of the policy.

The face value is stated in the policy documents and it often but not always stays the same as the death benefit throughout the life of the policy. The definition of fair market value is the price at which a willing buyer is willing to pay to a willing seller for a given good or service. Many factors are used to correctly ascertain the fair market value of a life insurance policy and calculating these factors is not an easy task.

What Happens When You Pass Away. The face value of life insurance is how much your policy is worth and more importantly how much life insurance money is paid out when the policyholder dies. In most cases the face value is transferred to the beneficiaries tax-free.

Cash value life insurance is a form of permanent life insurance that features a cash value savings component. Implications When You Die While your beneficiaries receive the face value of your whole life policy when you die they do not receive the accumulated cash value. The cash value of a life insurance policy is the accumulated balance inside the policy.

Whole life cash value chart whole life insurance quotes whole life insurance value cost of whole life insurance whole life insurance rates chart whole life insurance rates whole life insurance cash value whole life insurance value calculator Dada Hari. This is the stated dollar amount that the policys beneficiaries receive upon the death of the insured. The face value is the amount of insurance proceeds the policy pays to your beneficiaries upon your death.

The face value of a life insurance policy is the amount of death benefit you purchase when you take out the policy and its a primary factor in determining the amount of premium you pay. That balance results from premium payments that exceed the cost of insurance and the balance can grow or shrink depending on how the policy performs. Frequently asked and often misunderstood the face amount of life insurance is the initial amount of financial protection listed on a life insurance policy.

The amount of money that your insurance provider puts toward the policy is known as the face value and is the amount that will be paid out to your beneficiaries when you pass away. The face value never changes. The policyholder can use the cash value for many purposes such as a source of loans or.

Life Insurance Purposes And Basic Policies Mu Extension

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/couplewithson-af145eeffb774131a3e30d5bf68dde66.jpg)

What Is The Face Value Of A Life Insurance Policy

Glossary Of Life Insurance Terms Smartasset Com

Variable Life Insurance Policygenius

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole Life Insurance Definition

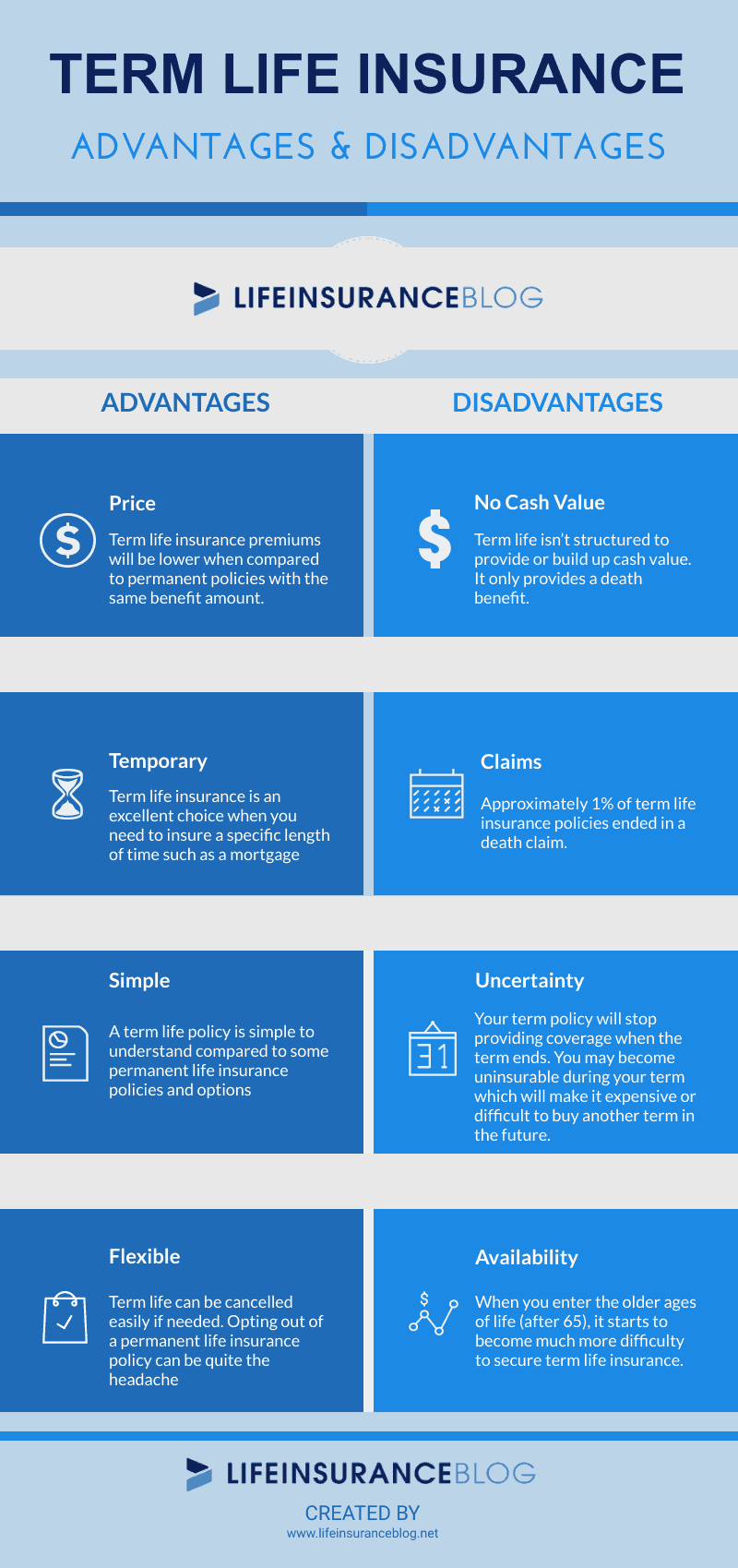

Advantages And Disadvantages Of Term Life Insurance Top 9 Facts

Whole Life Insurance How It Works

/life_insurance_151909996-5bfc371046e0fb005147a943.jpg)

How Cash Value Builds In A Life Insurance Policy

How Does Life Insurance Work Forbes Advisor

/GettyImages-1199059338_journeycrop_lifeinsurance-d3498103ef78406991ea4b4a7b401266.jpg)

Life Insurance Guide To Policies And Companies

2021 Final Expense Life Insurance Guide Costs For Seniors

Difference Between Cash Value And Face Value In Life Insurance

Cash Value And Cash Surrender Value Explained Life Insurance

Term Vs Whole Life Insurance Policygenius

What Are The Three Main Types Of Life Insurance The Insurance Pro Blog

How Does Whole Life Insurance Work Costs Types Faqs

Cash Value And Cash Surrender Value Explained Life Insurance

:max_bytes(150000):strip_icc()/Settlers_Life_Recirc-9f82b0d33f764e42acbb4a65da469269.jpg)

Post a Comment for "Define Face Value Of Life Insurance"