Does Life Insurance Pay For Suicidal Death

For traditional life insurance plans nominees will receive 80 of the amount of premium paid for death due to suicide within one year from the start of the policy. However if someone else causes your death he or she may be excluded from receiving the death benefits.

This would lead to very negative consequences for the life.

Does life insurance pay for suicidal death. If they did not have a waiting period many people who were thinking about suicide would take out a large policy right before they killed themselves. Since some suicide clauses cover the first two years of the policy the life insurance company could pay the family after that time. Whenever an insured person replaces an existing life insurance policy with a new one the time clock for the suicide clause is set back to zero and starts over again.

The deceased was not paying premiums. Many life insurance policies contain a suicide clause or provision. Although there is much misconception to the contrary the reality is that yes life insurance will pay out in the case of suicide.

If someone dies by suicide in the first two years of holding the policy there is no death benefit for beneficiaries. Many life insurance policies have an Accelerated Death Benefit rider ie optional provision which allows policyholders with a terminal illness to access part of the death benefit amount while they are still alive usually to help pay for needed care 2. Accidental Death and Dismemberment ADD coverage is an automatically included in Basic and Option A insurance for employees at no additional cost.

The insurance company may not be obligated to. Life insurance covers a policyholders suicidal death in many cases. If the coroner concludes that the death came as a result of suicide or intentional and serious self injury the life insurance policy will be cancelled if the death occurred within a year of the policy start date.

Suicide and life insurance are you guaranteed a life insurance payout after death in the UK. In these cases the insurance company does not have to pay the family if the death resulted from suicide. Most life insurance companies have a suicide clause.

If the suicide occurs within the excluded. The key rules The suicide clause Usually this clause states that no death benefit will be paid if the insured commits suicide within two years of taking out a policy. Life Insurance Payouts If the policy holder dies of suicide after the exclusionary period the insurance company will pay a death benefit.

This type of life insurance policy doesnt cover medical-related deaths or deaths by suicide. When a policy holder dies of suicide during the exclusionary period there will be no payout to the beneficiaries. These numbers are very huge however not all life insurance covers the number one fatality of depression.

However some life insurance policies include contestability and suicide clauses which must expire before a. There is also an incontestability clause in some policies. FEGLI life insurance benefits are payable regardless of the cause or location of death.

That being said a life insurance company will pay out a claim on death by suicide but not immediately after the policy was purchased. If death from suicide occurs after this period then the life insurance policy will pay out as it would for death from illness or other insured causes. Drum spoke to Development actuary at Sanlam Individual Life Karen Bongers and asked a few questions about how life insurance companies normally handle life insurance pay-outs when the cause of death is suicide.

Some policies include a suicide provision. Companies will typically not pay a death benefit if the policyholder commits suicide within. Life insurance policies usually include whats called a suicide clause This clause generally states that a life insurance policy wont pay out if a death is due to suicide within the first two years of the policy but the exclusion period can vary.

Your life insurance policy will pay out death benefits to your beneficiaries if you die from a motor vehicle accident drowning poisoning accidental drug overdose or another tragedy.

How Often Do You Think About Your Life Insurance Well You Re Not Losing Any Sleep Over It We Bet Should You Be Disability Insurance Insurance Priorities List

What Is Life Insurance And How Does It Work Money

The Keys To Mortgage Life Insurance Forbes Advisor

What Is Term Life Insurance And How Does It Work Money

Policy Experts Takes Pride In Educating Our Clients In Life Insurance Products That Is Best For Them And Life Insurance Broker Insurance Broker Life Insurance

Permanent Life Insurance With Living Benefits Life Insurance Marketing Life Insurance Marketing Ideas Life Insurance Facts

Pin By Mercy On World Financial Group Life Insurance Quotes Term Life Insurance Quotes Life Insurance Facts

Life Insurance Facts Figures Infographic Life Insurance Quotes Life Insurance Life Insurance For Seniors

Common Life Insurance Questions Department Of Insurance Sc Official Website

Individual Life Insurance Vs Group Term Life Insurance Fbs Life Insurance Quotes Term Life Life Insurance Facts

Life Insurance Rates Through The Ages Infographic Life Insurance Marketing Life Insurance Cost Life Insurance Quotes

Glossary Of Life Insurance Terms Smartasset Com

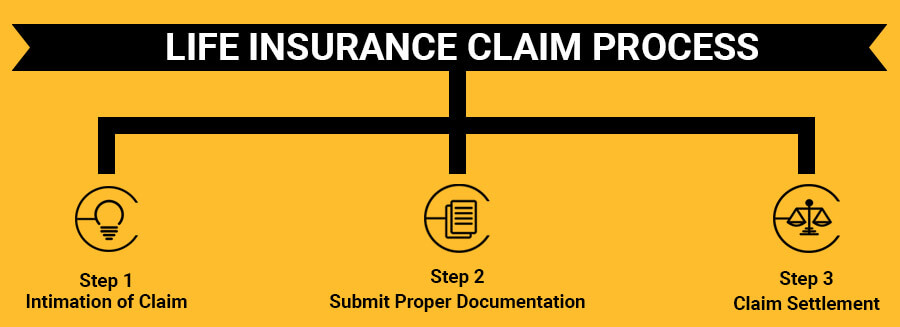

Life Insurance Claim Process And Required Documents Policyx Com

:max_bytes(150000):strip_icc()/How-to-find-out-if-there-was-a-life-insurance-policy-5796d7ec5f9b58461f790ced.jpg)

Does Life Insurance Cover Suicide

Life Insurance Claim Process And Required Documents Policyx Com

When Is The Best Time To Buy Life Insurance Insurance Investments Life Insurance Insurance

Life Insurance Claim Process And Required Documents Policyx Com

Post a Comment for "Does Life Insurance Pay For Suicidal Death"