Does Term Insurance Have Cash Surrender Value

Only policies such as ULIPs or endowment policies that have a savings component embedded will partially return the amount invested for life cover. This process is the same for both permanent life insurance such as whole life and universal life and term life insurance.

Second To Die Life Insurance And When It S Appropriate By Far The Most Common Type Of Life Insurance Quotes Life Insurance Life Insurance For Seniors

A policy acquires surrender value only when premiums for full three years have been paid to the insurance company.

Does term insurance have cash surrender value. The cash surrender value is the amount of money an insurer will pay you if you surrender a permanent life insurance policy that has a cash value. In most cases CSV is only going to be applicable for whole life and universal life insurance policies. Because term life insurance policies do not have a cash value they are about five - 15 times less expensive than permanent policies that have a cash value component.

You get to use it as long as youre paying the premiums but when the term comes to an end theres nothing left over. If you decide to end a term life insurancepolicy you wouldnt get any money back because theres no cash value. Only permanent life insurance policies have a cash value which can be used to take out a loan surrendered for cash or used to pay premiums.

Term insurance which typically lasts for a. What is term life insurance cash value. The cash value in term life insurance is generally zero since traditional term insurance does not have a cash accumulation component.

Term life insurance is only an insurance policy -- theres no investment component which a whole life insurance policy does have. After the surrender period has ended there are no more surrender charges. Universal policies offer a surrender period where you could use up to 10 of your policys cash value without having to pay a surcharge.

Cash value and cash surrender value can be the same amount if youve held the product for long enough but they often differ due to fees. Once youve begun accumulating cash value in a life insurance policy you can use. Wondering whether there is cash surrender value in term life.

Universal Life Insurance Cash Surrender Value. Term insurance buys pure protection rather than building up a cash value and that is why the costs of Term life insurance is usually lower than policies that have cash value. Surrendering a policy cancels your coverage.

Pure term plans with no savings element will lapse and all the benefits. Cashing out life insurance is easy you will need to let your insurance company know that you want to surrender your policy. Term coverage doesnt typically have a surrender value though with some policies you can at least.

This matters a lot if you need to withdraw cash from your policy or simply want to cancel your insurance. No Term Life Insurance does not have a cash surrender value in most cases. Typically the amount of cash surrender value increases as the policys cash value increases and the surrender period decreases.

Term life insurance does not have cash surrender value because these policies have no cash value. The cash surrender value is therefore the amount of money that you will get after all fees and charges have been assessed and it will be less than the policys actual cash value during the surrender period. Term life insurance works kind of like a rental.

Term life insurance is usually the cheapest kind of life insurance to buy because it has no cash surrender value and it lasts for only a certain number of years such as 10 20 or 30. Variable-universal life insurance. How to cash out life insurance.

Life insurance policies are intended to be held for the long-term Also surrender value differs slightly for insurance policies and annuities. Universal life insurance doesnt typically include a guaranteed cash value but it can be surrendered after the first year. No Term life insurance does not usually have a cash surrender value.

You should calculate the surrender fees if you no longer need your policy and are thinking of using the money. Also not all policies will acquire surrender value. If you want to cancel and cash.

And you should understand that the amount is going to be your accumulate investment. Term insurance is less complicated providing basic low-cost insurance coverage with no frills. That makes some people consider term life insurance a waste if you dont die because youve paid.

Cash surrender value is the sum of money an insurance company pays to a policyholder or an annuity contract owner if their policy is voluntarily terminated before its maturity or an insured event. It is important to know though that before you do that you should. The cash surrender value is the cash value of your insurance policy.

ROP Return Of Premium Term costs more than regular Term Life Insurance but does return the premiums paid in at the end of the Term if the Insured is still alive. While variable life whole life and universal life insurance all have built-in cash value term life does not. Term insurance has a low cost up front because it does not have a cash value accumulation.

Tapping your cash value may have consequences such as a loss of coverage surrender fees or tax liability.

Start Investing On Mutual Fund Today For More Information Call Us 91 9897317 Life And Health Insurance Life Insurance Marketing Ideas Life Insurance Facts

What Is Your Reason For Not Buying A Life Insurance Life Insurance Facts Life Insurance Quotes Life Insurance

16 Most Important Car Insurance Terms Infographic Car Insurance Tips Car Insurance Renew Car Insurance

The Life Insurance Sale Process Life Insurance For Seniors Life Life Insurance Policy

Suitability Of Life Settlements In 2020 Life Insurance Premium Life Life Insurance

Cash Surrender Value Of A Life Insurance Policy Life Insurance Quotes Life Insurance Life Insurance Policy

Pin On Insurance Savings Investments Freedom

Whole Life Insurance What You Need To Know Whole Life Insurance Life Insurance Quotes Life Insurance

Pin On Cash Out A Life Insurance Policy

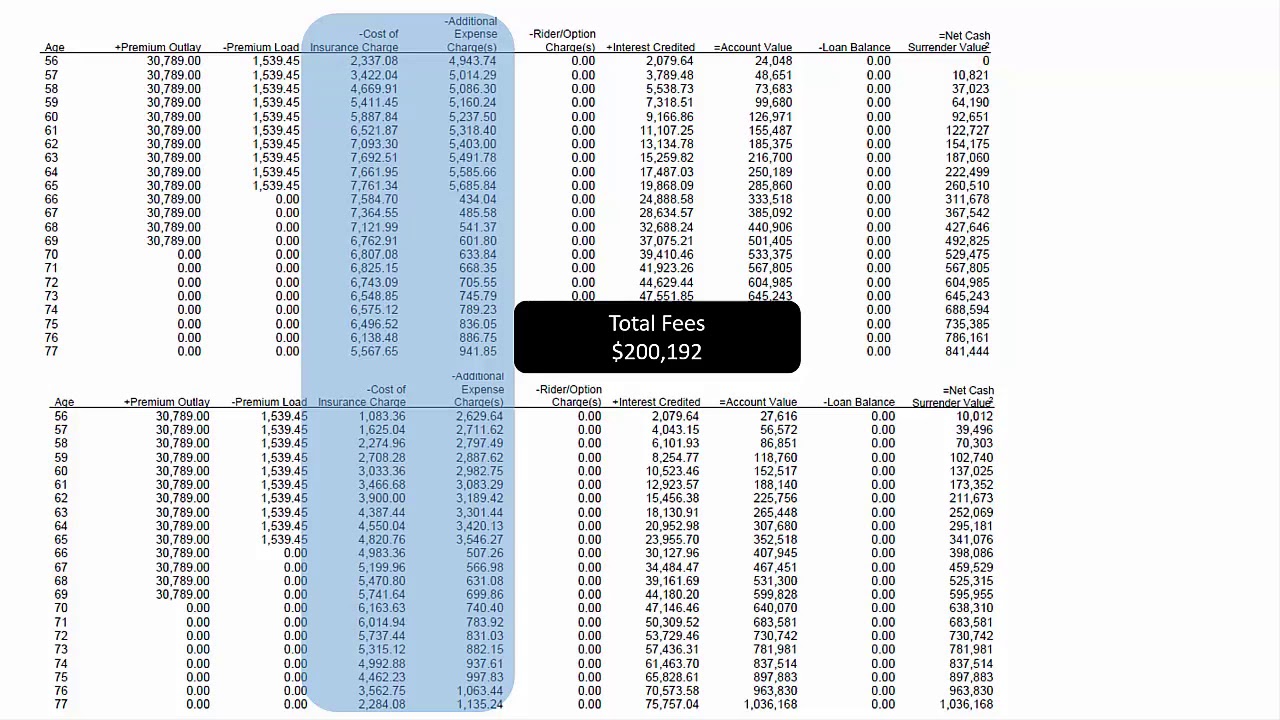

Indexed Universal Life Iul Insurance Fees Explained Universal Life Insurance Life Insurance Companies Life Insurance Policy

Sample Letter Format For Surrender Of Life Insurance Policy Life Insurance Policy Insurance Policy Life Insurance

Term Plan Life Insurance Facts Universal Life Insurance Life Insurance Quotes

One Of The Most Popular Uses For Whole Of Life Insurance Is For Final Expenses Such As Funerals Nur Life Insurance Quotes Life Insurance Life Insurance Policy

Pin By James On Propagan Life Insurance Sales Insurance Sales Get Your Life

What Is A Money Back Policy Meaning Of Money Back Life Insurance Policy Life Insurance Policy Life Insurance Premium Insurance

Collateral Assignment Life Insurance Policy Sample Form Life Insurance Policy Insurance Policy Insurance

Life Insurance Infographics Contact Our Team Of Experts A 1 800 366 2751 For The Best Life Pol Life And Health Insurance Life Insurance Life Insurance Policy

Post a Comment for "Does Term Insurance Have Cash Surrender Value"