How To Find Face Value Of Life Insurance Policy

Going to a MetLife office will allow you to check on the value of the life insurance policy and have any other questions answered in person. In most cases the face value is transferred to the beneficiaries tax-free.

Difference Between Cash Value And Face Value In Life Insurance

In most cases the face value is transferred to the beneficiaries tax-free.

How to find face value of life insurance policy. Read about how to determined the face value for any life insurance policy and see what circumstances can trigger a change in face value. Fair Market Value FMV. It can also help pay future premium payments on your policy.

This is the stated dollar amount that the policys beneficiaries receive upon the death of the insured. With an added cash value option your life insurance policy can help contribute to a retirement nest egg or rainy day fund for immediate access to cash. When a life insurance policy is identified by a dollar amount this amount is the face value.

A 500000 policy therefore has a face value. The face value of your life insurance policy is your death benefit -- the amount of money that you will leave your beneficiary should you die. Most people who buy policies with maturity dates in the future expect to make a profit.

Let me make up a situation to create an excuse to answer. The IRS defines fair market value to be the price at which property would change hands between a willing buyer and a willing seller. This is the dollar amount that.

The Advantage of Cash Value. A policys face value can be supplemented by additional benefits that have been added beyond the basic plan coverage. You dont have the policy paperwork for a policy on s.

The cash value or surrender value is a savings component included in some life insurance policies that can accumulate cash value from premium payments. Take the policy number and policy paperwork with you as a reference. You can find this number on your most recent statement from the insurance company or you can call your insurance.

By using Investopedia you accept our. Many forms of life insurance term and whole life allow for increasing and decreasing death benefit amounts. Scroll down to learn more about checking the value of old life insurance policies.

This is the stated dollar amount that the policys beneficiaries receive upon the death of the insured. How to check the value of an old life insurance policy starts by determining if the policy is a cash value or any other type of permanent policy. The 20000 that remains will be collected by the insurance company.

A life insurance policy has a face value and a cash value and they are two different numbers. For any life insurance policy the face value is the death benefit. For instance if the face value of your whole life policy is 200000 and the cash value that has accumulated is valued at 20000 when you pass away the beneficiaries of your policy will receive the 200000 face value of your policy.

Of course if you were selling a life insurance policy with a fixed payout its unlikely that you would have such a kind friend standing by to pay for your policy. John Geares answer is absolutely correct - as far as it goes. However in some situations the death benefit can be less.

Its the amount of death benefit purchased which indicates the amount of money the policy will pay to the beneficiary or beneficiaries when the insured person dies. Life Insurance Policy Valuation Factors. The face value or face amount of a life insurance policy is established when the policy is issued.

The face value is the death benefit. Step 4 Select the Customer Service tab in order to find the contact information for MetLife. Normally you would find that you would have to sell your policy for quite a bit less than 310599 to make it attractive to someone.

Your question doesnt include the situation details nor circumstances. As an example a consumer may purchase a whole life insurance policy with a 100000 Face amount. Investopedia uses cookies to provide you with a great user experience.

For example a policy with a face amount of 1 million will be much more valuable than one with a face amount of 100000. For any life insurance policy the face value is the death benefit. Depending on the type of life insurance policy purchased you may retain the option to cash in the policy for whatever the surrender value is or keep the policy in-force as an investment.

Face value is different from. The net surrender cash value of a permanent life insurance policy is the amount youll keep if you surrender the policy and forfeit the death benefit. 4 Ways of Determining Life Insurance Policy Value 1.

To determine the face value of your policy review it. The amount of death benefit that the policy will pay is always a substantial factor in determining the value of a life policy. The Face Amount will be listed in the policy contract.

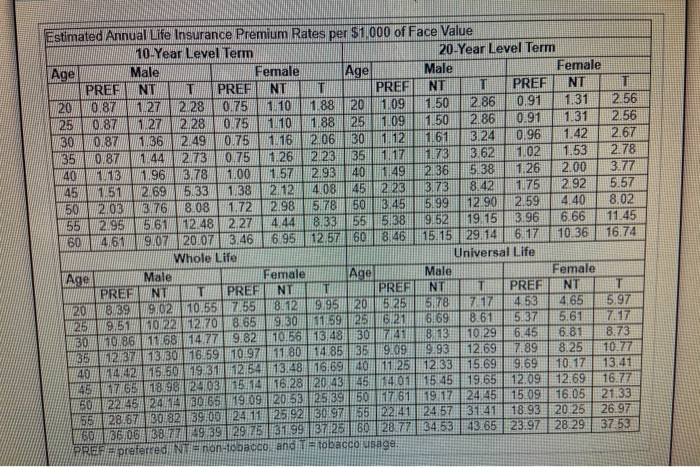

X Education Reference Dictionary Investing 101 The 4 Best SP 500 Index Funds Worlds Top 20 Economies Stock Basics. In 2018 the average face amount of individual life insurance policies purchased in the United States was about 168 thousand US. Some of the factors that go into determining the value of your life policy include.

What Does It Mean When A Life Insurance Policy Is Paid Up Life Ant

How Does Whole Life Insurance Work Costs Types Faqs

Best Life Insurance For Seniors

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole Life Insurance Definition

How Does Life Insurance Work Forbes Advisor

Types Of Life Insurance Policies Forbes Advisor

Index Universal Life Insurance Get Flexible Life Insurance Quotes Universal Life Insurance Life Insurance Facts

Sales Improvement On Life Insurance Policies Introduction Introduction Of Life Insurance Life Life Insurance Companies Life Insurance Policy Life Insurance

Cindy Started A Whole Life Insurance Policy For Chegg Com

What Is Life Insurance And How Does It Work Money

17 Best Life Insurance Companies Of August 2021 Money

Surrendering Your Life Insurance Policy Keep These Things In Mind Before Doing So The Financial Express

Term Vs Whole Life Insurance Policygenius

What Does It Mean For A Life Insurance Policy To Mature Life Ant

Life Insurance Over 70 How To Find The Right Coverage

Understanding The Life Insurance Medical Exam Policygenius

Why Almost Every Life Insurance Policy With Cash Value Stinks

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)

/life_insurance_151909996-5bfc371046e0fb005147a943.jpg)

Post a Comment for "How To Find Face Value Of Life Insurance Policy"