What Do Extended Term Insurance Mean

Term insurance is a type of life insurance policy that provides coverage for a certain period of time or a specified term of years. Extended Term is a Default Non-Forfeiture Extended term insurance is the default non-forfeiture options.

Let Us Know What You Did To Pay It Forward Life Insurance Awareness Month National Life Insurance Life And Health Insurance

Extended term insurance is life insurance is a life insurance policy where the policy holder stops paying the premiums but still has the full amount of the policy in effect for whatever term the cash value permits.

What do extended term insurance mean. Extended term life insurance is coverage that is provided by the cash value in a life insurance policy. When your term comes to an end you may have the option of extending your insurance policy. Extended term insurance is a type of life insurance that is designed to make whole life insurance more attractive.

Extended Term means the Term together with the period thereafter if any before the expiration or termination of the last-to-expire Subscription Term. Most term life insurance policies dont actually expire. Extended Term Insurance Law and Legal Definition.

Here are the basics of extended term life insurance and how it works. If the insured dies during the time period specified in a term. The feature primarily seeks to help those who find themselves in a situation where the whole life premium is no longer affordable.

This means that you have a specified window in which you can convert your policy to a permanent life insurance policy. Extended term insurance is a nonforfeiture option on a whole life policy that uses the policys cash value to buy term insurance for the current whole life death benefit for a specified period of time. Before making a financial plan for yourself it is very important to know the actual meaning of term insurance.

Extended term insurance is a type of life insurance in which a policyholder can continue receiving coverage without paying premiums. Extended Term Insurance a nonforfeiture provision in a whole life policy that uses cash value to purchase term insurance equal to the existing amount of life insurance. Extended term insurance is a nonforfeiture option which may be included with insurance to extend the coverage for a limited period of time upon the failure of a policy-holder to pay the premiums.

If premiums are not paid any dividend additions or accumulations minus any indebtedness will be. Based on 6 documents. When you purchase a whole life insurance policy part of the premiums that you pay are going to go towards accumulating a cash balance.

Extended term insurance is a type of life insurance that is designed to make whole life insurance more attractive. Definition of Extended term insurance Nancy Danyo Cuddihy Real Estate Agent Premiere Realty Group LLC Nonforfeiture option that uses the cash value of an ordinary life policy as a single premium to purchase term life insurance in the amount of the original policy. The equity you built is used to purchase a term policy that equals the number of years you paid premiums.

Click here to know about what is term plan its meaning definition more. Extended coverage is insurance coverage that goes beyond what a standard policy offers. HDFC Life helps you understand what is term insurance with complete guidelines about it.

Extending your term life insurance policy. The policy is usually a whole life policy but can originate from other cash value plans. It often covers perils less likely to occur.

Here is an example. Extended insurance definition is - life insurance that after cessation of premium payments is continued in its original amount for the period allowed by the cash value. Not The Same as Extended Coverage This is not to be confused with extended coverage a term used in the property insurance business.

Buried within the terms and conditions your term life insurance normally covers you till the age of 95. With the extended term insurance the face amount of the policy stays the same but it is flipped to an extended term insurance policy. You have a 100000 whole life policy that has built up some cash value.

What do I mean when I say that the timing of your term life insurance conversion is important. Not all policies are created equal. Life insurance in which a policyholder ceases to pay the premiums but keeps the full amount of the policy in force for whatever term the cash value permits.

Here are the basics of extended term life insurance and how it works. Some companies only allow conversions of your term life insurance policy on a Period basis. What Does Extended Coverage Mean.

Extended Term means a period of fifteen 15 years following the expiration of the Initial Term. Typically it is purchased separately from a standard policy and functions as an extension of the primary coverage.

How To Get Health Insurance On The New York State Exchange What To Consider Where To Look How To Do It Done Family Income How To Get Health Insurance

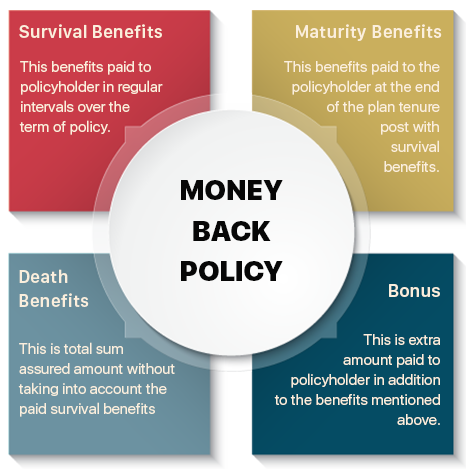

Money Back Policy Compare Money Back Plans Features Reviews

Who Should Buy 100 Year Term Insurance Plans Bfsi

Term Life Insurance Policygenius

The Best Life Insurance Companies Of July 2021 Life Insurance Quotes Life Insurance Policy Life Insurance Companies

Insurance Guide Axa Auto Insurance Dubai Car Insurance Bodily Injury Insurance

5 Key Life Insurance Tips And Advice To Protect Your Family Life Insurance Policy Best Health Insurance Life Insurance

How Does Whole Life Insurance Work Costs Types Faqs

Short Term Vs Long Term Disability Insurance Disabilityinsurance Insurance Disability Term Life Insurance Quotes Life Insurance Quotes Disability Insurance

When Your Weather App Gives You Inspirational Quotes To Keep On Living Term Life Best Insurance How To Protect Yourself

How Hybrid Life Insurance Pays For Long Term Care Forbes Advisor

Salary Change Form Lovely 7 Salary Change Form Template Salary Change List Of Jobs

Term Plan With Return Of Premium Trop 2021 Policybazaar

Homeowners Insurance Cover Compare Home Insurance Options And Deals Homeowners Insurance Coverage Home Insurance Quotes Home Insurance

Uha Factors That Impact Health Insurance Premiums Health Insurance Insurance Premium Health

Term Life Insurance Explained Forbes Advisor

Health Insurance Is A Great Deal For Women Health Insurance Benefits Affordable Health Insurance Health Insurance

Life Insurance For Seniors Over 70 Life Insurance For Seniors Life Insurance Policy Affordable Life Insurance

Post a Comment for "What Do Extended Term Insurance Mean"